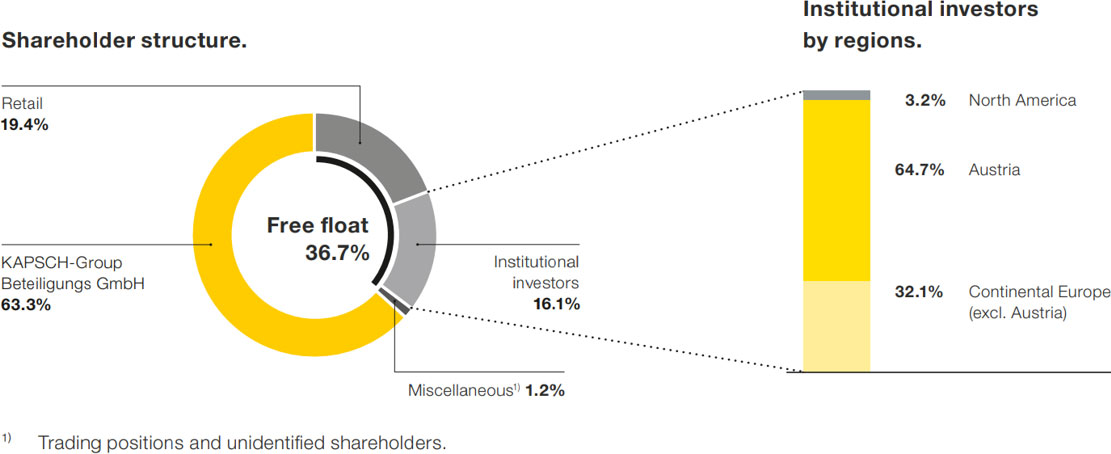

63.3% of the shares in the company are owned by KAPSCH-Group Beteiligungs GmbH. Free float amounts to 36.7%.

Free float according to the Prime Market rules of the Vienna Stock Exchange shall be defined as all stocks (up to 25% of the stock capital) that are held by investment funds, pension funds or investment management companies as long as these do not have the features of a special fund or imply a long-term investment strategy (for strategic goals, to influence company policy or business activities).